RESEARCH REPORT

From resiliency to growth in commercial aerospace

4-MINUTE READ

RESEARCH REPORT

4-MINUTE READ

Despite challenging macroeconomic and geopolitical conditions, airlines will return to profitability in 2023 and overall commercial aerospace revenues will grow by 11% year-on-year. And in 2024, the industry is set to exceed revenues not seen since the pandemic. While supply chain issues persist, Generative AI’s transformational promise is fueling greater optimism for significant performance gains across multiple enterprise functions.

The aerospace industry looks like returning to very close to pre-pandemic revenue levels in 2023 and is on target to exceed them by 2024. Commercial revenues for Airbus and Boeing both rose significantly year-on-year (18% and 40% respectively) and the MRO market is also seeing rising demand. Overall commercial deliveries increased by 13% in the first nine months of 2023.

Airline profitability up

Airlines will return to profitability in 2023 with global industry profits of $9.8 billion predicted for 2023, following losses in 2021 and 2022. Airlines in all regions have seen improved financial performance as air passenger traffic came roaring back in 2023.

Aircraft deliveries up but expected to dip

Customer deliveries increased in the first nine months of 2023 compared with the same period in 2022. However, despite this positive trajectory, executives have revised down their overall expectations for 2023 aircraft delivery. Just 50% (against 64% in April 2023) said that they expected higher deliveries in narrow-body segments, with only 41% expecting an increase in wide-body (against 70% when asked in April 2023).

MRO’s recovery continues

Rising freight and passenger demand in 2023 has driven steady recovery in the MRO market. As supply chain issues persist for new aircraft, MRO demand is set to increase as airlines seek to reconfigure older aircraft. In addition, increasing freight traffic (particularly in the Asia Pacific region) is pushing demand for passenger-to-freight conversions.

Persistent supply chain disruption set to ease

Executives continue to voice their concerns about supply chain disruptions, driven by a combination of shortages across spare parts and materials. However, 72% express greater optimism about both the quality and timeliness of their supply chains for the next six months. While that proportion is still short of the very high levels of confidence seen pre-pandemic (88%), 94% of executives surveyed have confidence in the ability of their suppliers to meet or exceed expectations within the next 24 months.

of aerospace executives expect Generative AI (Gen AI) to have a transformational impact on their organization.

expect to see that transformative impact begin to occur across functions within the next three years.

say that they are already exploring use cases for Gen AI. Particular areas where executives anticipate Gen AI’s positive impacts include on the supply chain.

expecting it to increase resiliency and transform supplier and risk management.

say customer service and support will also see Gen AI-driven improvements and

see accelerated innovation and faster time to market for new products and services as a clear benefit from Gen AI.

However, it’s also clear that if Gen AI is to live up to its potential, aerospace companies and the industry at large will need to get out in front of a myriad of concerns related to trust and security. They will need to develop a systematic approach to responsible AI.

What keeps aerospace executives awake at night?

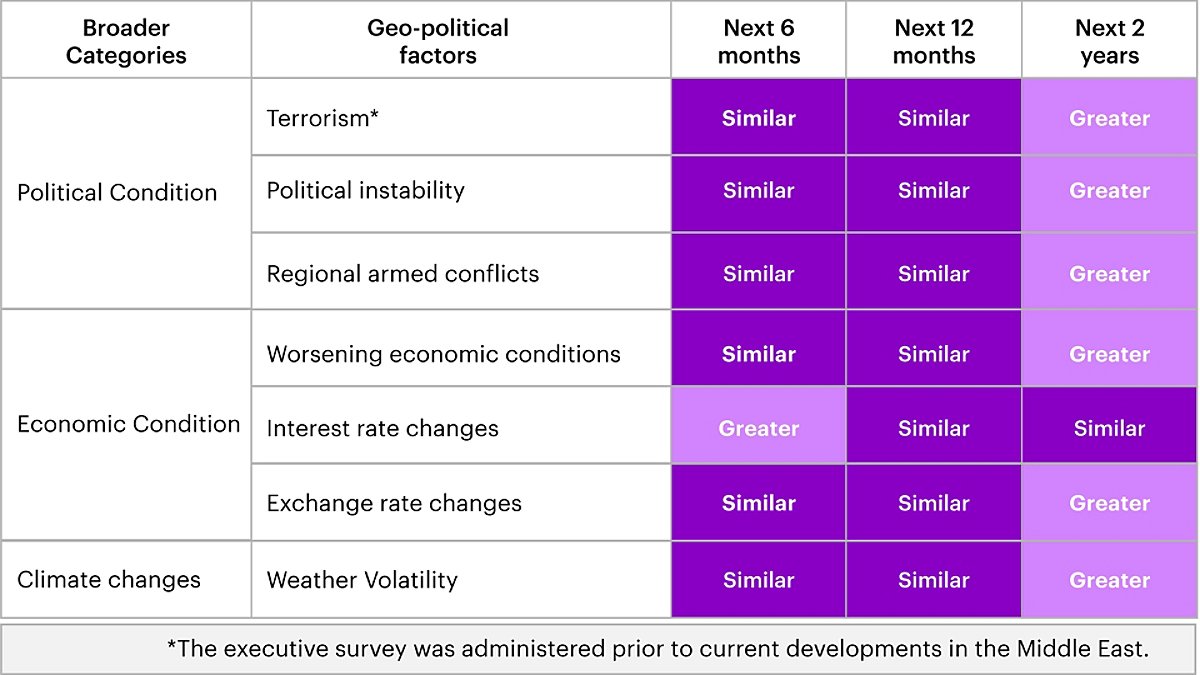

In the short term, interest rate changes is the risk that executives are identifying as a greater concern in the next six months. However, across the board, executives see risks from climate change to political instability increasing in the next two years. In response, they are scenario planning to mitigate the impact of these risks should they materialize.

Executive geo-political risk concern levels

Survey conducted prior to developments in the Middle East.

About the Accenture commercial aerospace market insight report

Combining sophisticated econometric modeling methodologies to drive quantitative quarterly forecasts on the health of the commercial aviation market, with insights from leading aerospace executives worldwide, the Accenture Commercial Aerospace Insight Report provides a unique perspective on short- and medium-term trends and drivers in this market, covering a wide range of activities, from suppliers to MROs. Our poll was conducted in August 2023 and views are subject to considerable change as conditions can rapidly evolve.

Listen in as Aviation Week and Accenture take a look at some of the bigger-picture issues in the world of aerospace and defense.