RESEARCH REPORT

Letting go to grow

The secrets to seizing value from divestitures

5-MINUTE READ

RESEARCH REPORT

The secrets to seizing value from divestitures

5-MINUTE READ

Macroeconomic conditions, geopolitical tensions, rising interest rates, depressed valuations, activist investors and other competing headwinds brought portfolio rebalancing to the top of the C-suite agenda. In turn, executives have approached their rebalancing efforts in much more accelerated, provocative and value-driven ways.

Under these conditions, serial dealmakers know that M&A is a crucial lever for growth. Divestitures, however, remain a muscle that’s underutilized as a lever for growth and, as a result, divesting capabilities have generally gone untested in a “serial” sense.

Divestitures are an important lever for growth—and reinvention—and trends indicate they are about to have their time in the sun. Are executives ready?

A convergence of forces is increasing volatility: Accenture’s Global Disruption Index shows that levels of disruption increased by 200% from 2017 to 2022. “Always on” structural shifts in how companies operate are now the norm. In fact, even in the face of recession in 2023, recent Accenture analysis revealed that 75% of executives say the pace of their organizations’ reinvention will accelerate.

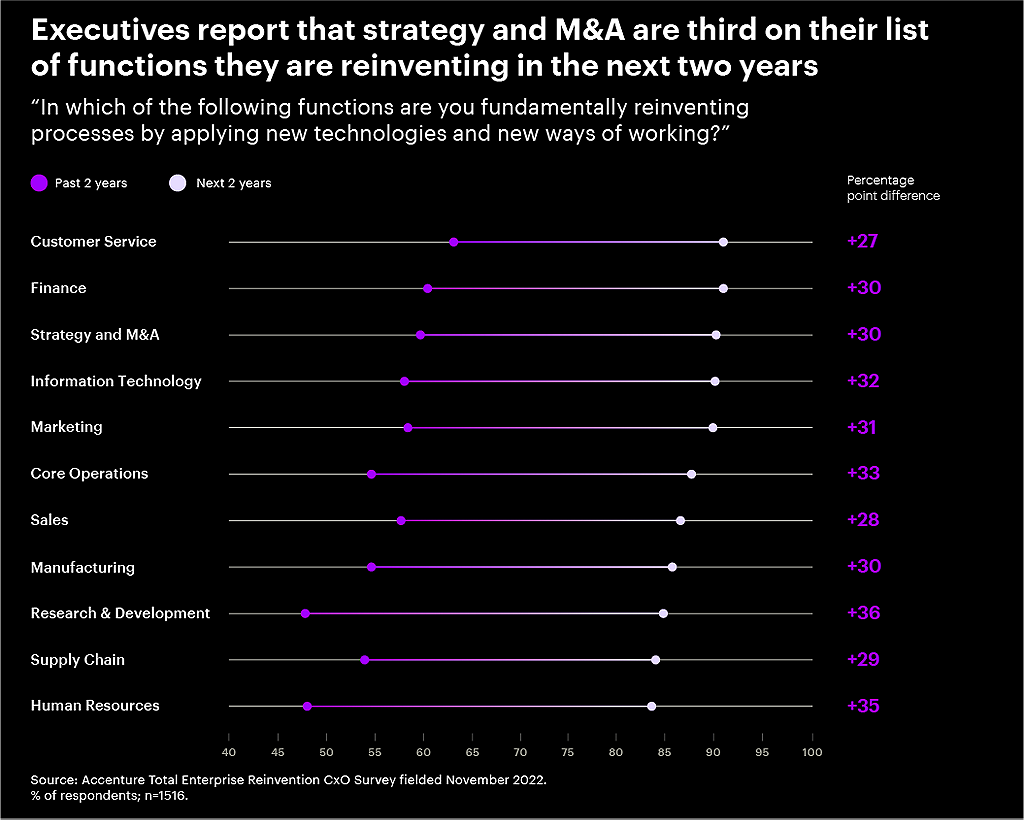

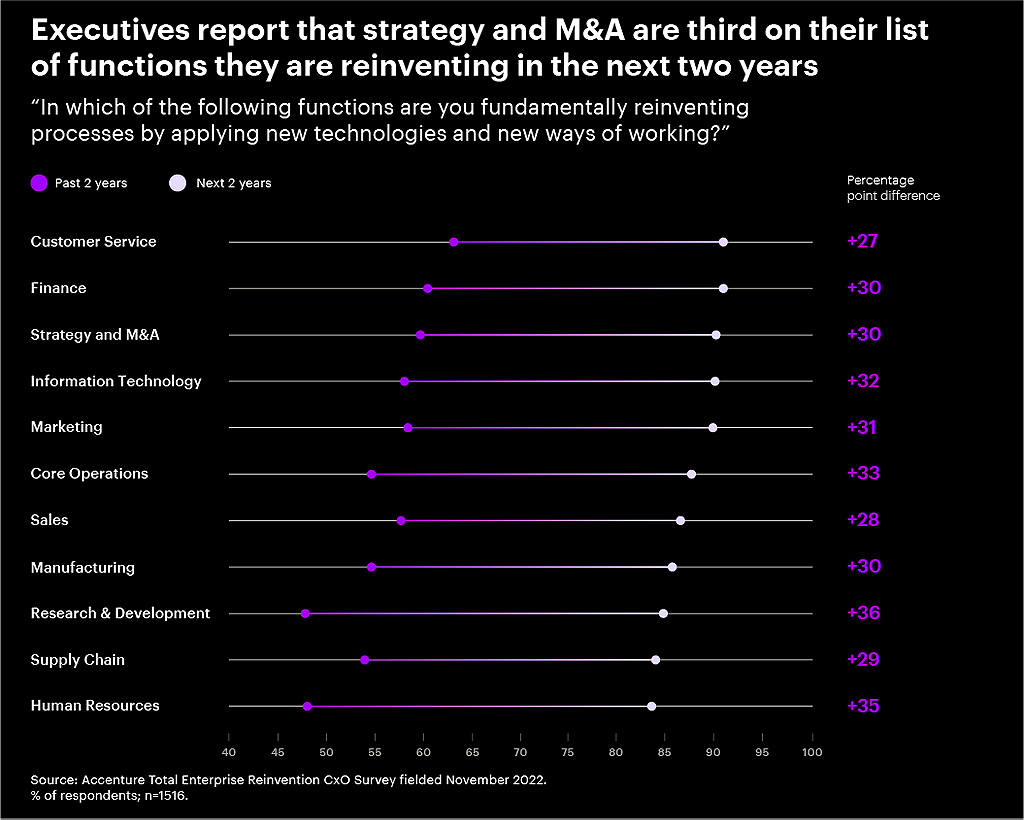

M&A has long been understood as a lever for inorganic growth, and more recently, it’s become an essential part of strategies for reinvention. Of 11 functional areas assessed in that same analysis, strategy and M&A functions were identified by executives to be among the top three they are fundamentally reinventing.

Business leaders have an opportunity to simultaneously reimagine the role of divestitures as an essential component of their reinventions and, ultimately, their strategies for growth. The conventional motivation for divesting has been “let go to throw”—in other words, cut out underperforming parts of a company. Historically, companies have used divestitures as a lever for monetizing those assets in their portfolios or assets that have a different investor profile.

Now, company leaders are putting more focus on natural synergies versus portfolio diversification, seeking to divest non-core assets or business units that no longer add shareholder value and also free up capital for strategic initiatives and focus management on critical KPIs. But as a lever for growth, divestitures have—as yet—been underutilized, despite seeing an uptick during the pandemic. That’s changing, as leaders increasingly see the value of interrogating their overall portfolios.

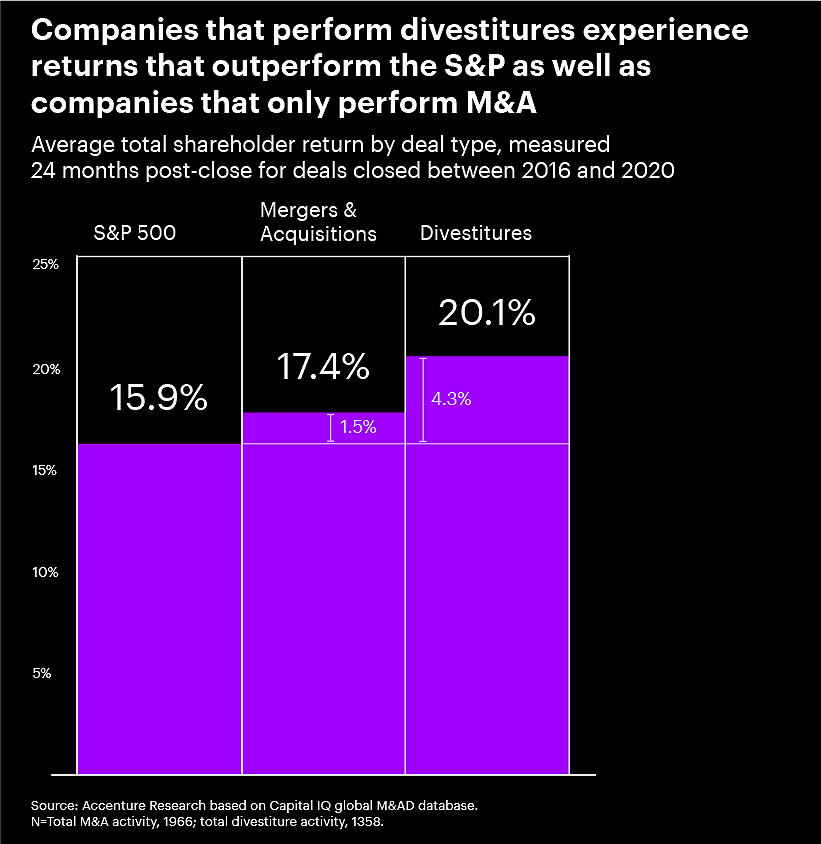

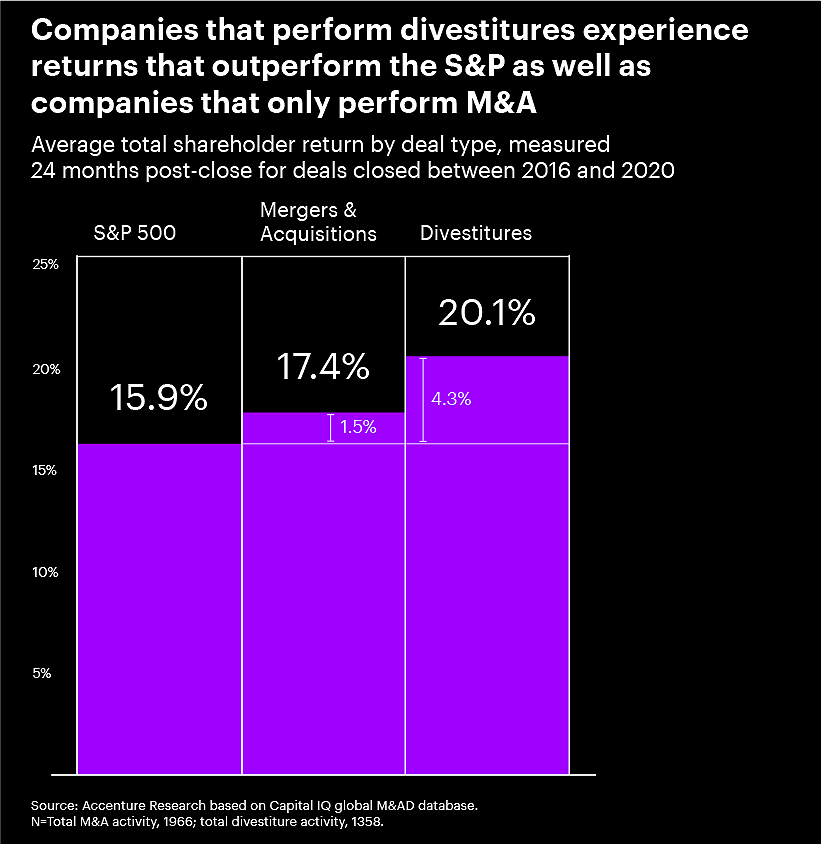

Leading divestors are demonstrating the power of letting go to grow: From 2016 to 2020, businesses that completed divestitures had an average two-year total shareholder return (TSR) that outperformed the S&P 500 at a rate almost three-times higher than businesses that only made acquisitions during the same period.

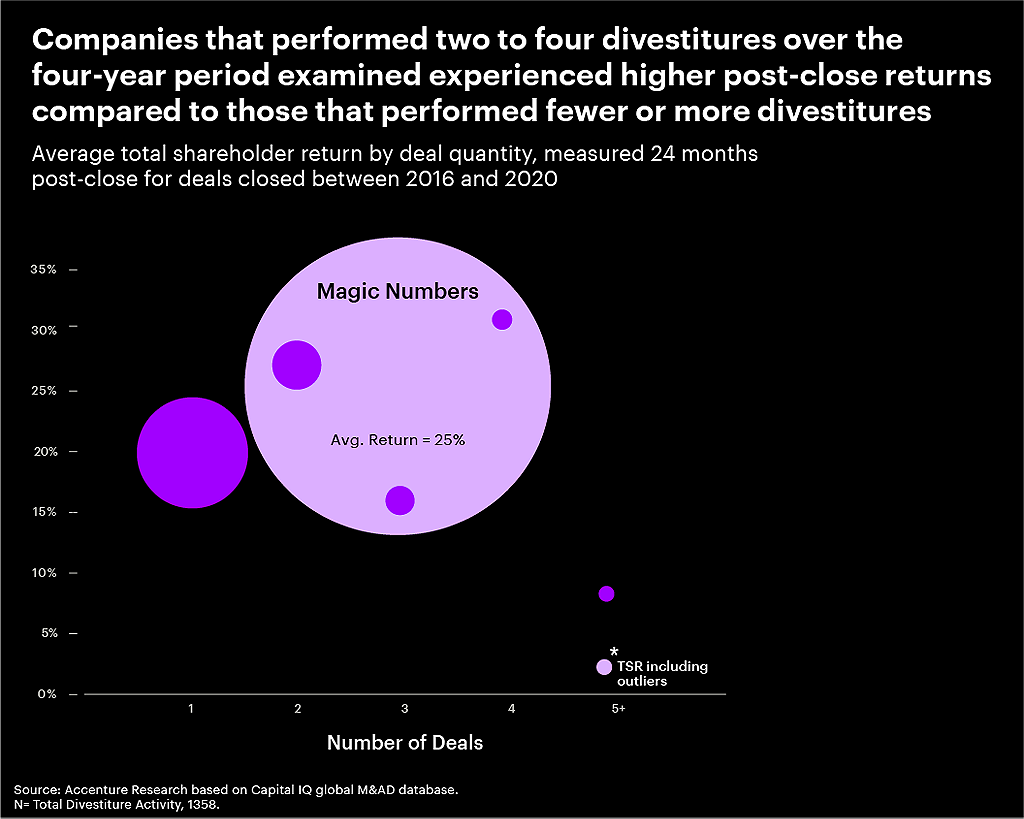

Accenture analysis of divestiture activity from 2016 to 2020 revealed something else: Companies that get the balanced recipe for “serial” divesting right win. Of the more than 1,300 divestiture transactions studied from 2016 to 2020, the vast majority (77%) were by companies that closed only one deal during that period and experienced an average return of nearly 20%. On the flip side, companies that closed more than five deals during that period saw their returns average only 1%.

But the remaining 21% of transactions—by companies that closed between two and four deals for the same period—experienced average returns of 25.1%.

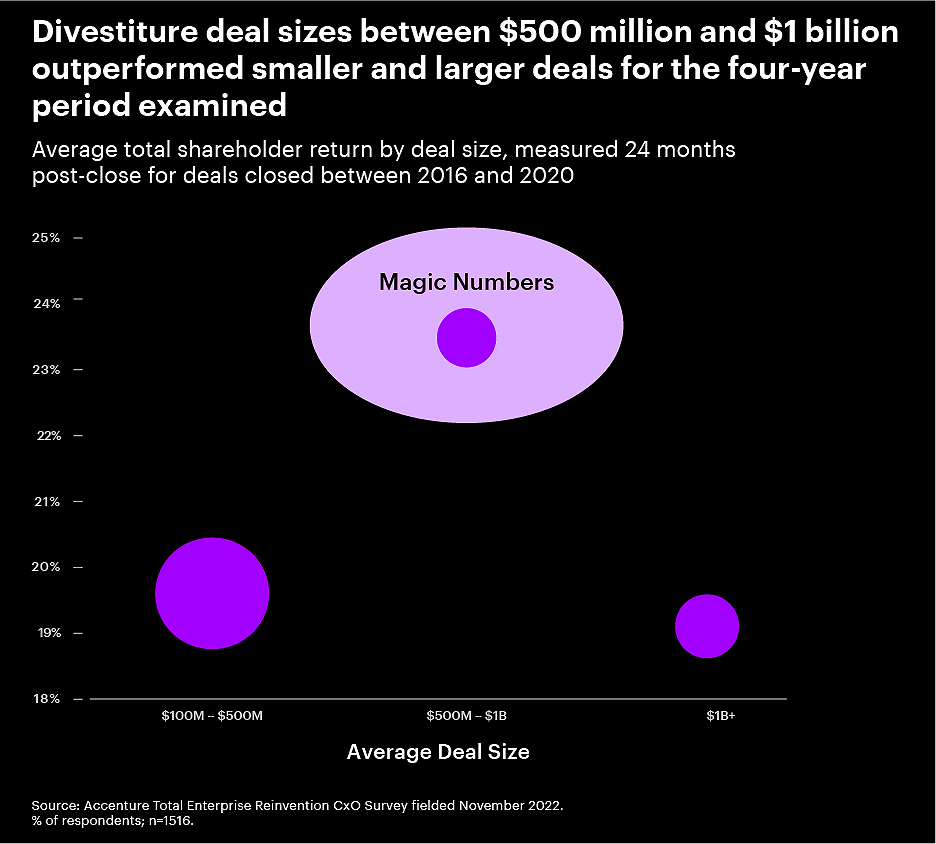

Our analysis revealed similar insights with regard to deal size. Companies performing divestiture deals between $500 million and $1 billion—17% of total transactions for the period—experienced significantly higher TSRs than in smaller or larger deals.

A divestiture is not a merger in reverse. In a merger, 80% of the work completed is post-close. In divestitures, it’s the opposite. Most time in conventional divestitures is spent by lawyers, accountants and bankers on the transaction stream to “get the deal done.” This disproportionate attention is to the detriment of where the energy should be invested with divestitures and the value truly lies: the operational stream.

While it’s important to manage the transaction itself, overall deal value—and TSR—is maximized through successfully executing the operations separation. That means employing certain success factors to achieve a successful separation and seamless Day One for both the new entity and the remaining company. Without the presence of these success factors, things can go downhill—fast. A failed, delayed or ineffective divestiture can result in cascading effects that impact TSR.

Shared services play a key role in divestiture planning and execution. Partnering with an experienced end-to-end outsourcing provider can deliver speed and value, as well as help mitigate typical separation challenges like transitional services agreements (TSAs).

Unlike mergers, ambiguity in separations is much more prominent given the wide array of possible outcomes. In particular, separations can be unsettling to employee stakeholders and can adversely impact morale. That’s why companies need a robust and transparent change management strategy to help provide clarity for all stakeholders—especially for “ring fenced” employees and customers (ones who are attached to a business unit being divested).

A divestiture can be a catalyst to leapfrog technology, evaluate broader systems migrations and reinforce a company’s overall business transformation—and still deliver significant value to shareholders. Delivering a separation with speed delivers significant value, so sellers will want to get their IT ducks in a row ahead of Day One. Most prominently, that means a focus on speed and security, which have risen to the top of key IT decisions.

Divestitures provide companies with significant opportunities to reimagine their brands. Failure of a brand strategy can create a misalignment on brand perception and complicate the separation. It’s essential to determine what will resonate with key stakeholders, identify the North Star for the brand, then reposition it toward its new purpose. When done right, a comprehensive brand strategy can set the foundation for long-term growth.

Divestitures done right are not just tactics to cut underperforming parts of the business—but powerful levers for growth. Ultimately, there are three key imperatives for leaders to keep in mind:

A divestiture is when a company sells, spins off, or carves out part of its portfolio to rebalance a portfolio, to cut out under-performing or non-core parts of its business, or increase the value of the parent company.

The two main methods of divesting are through private and public sales. Private sales comprise the sale of assets or whole business units to a trade buyer and/or financial investors. Public sales include: IPOs, spin-offs, and split-ups.

Portfolio rebalancing—inclusive of divestitures and M&A—is part of an intentional business strategy to generate value for either the RemainCo, NewCo or both. Divestitures done well have the potential to generate as much or more value than M&A deals.

The focus of divestiture deals needs to extend beyond the transaction stream and get the operational elements right or risk poor execution that results in costly TSAs, talent attrition and decline in employee morale, and loss of stakeholder confidence.